Trading and Dealing in Security Markets – FINC3014 Notes

Summary:

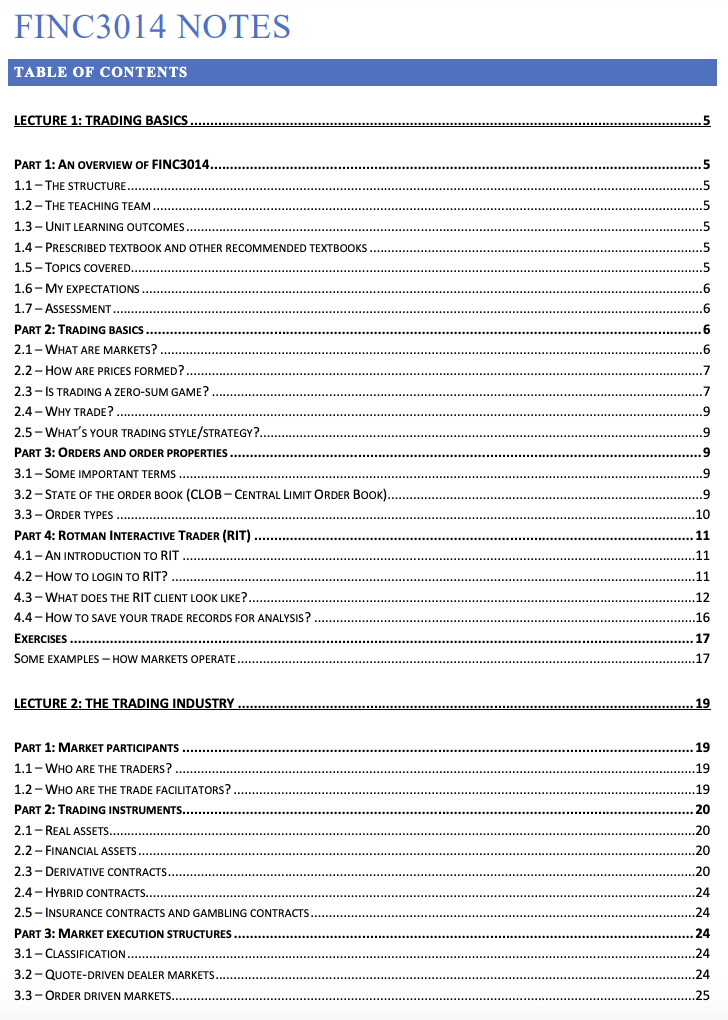

The notes cover various topics related to trading, market structures, market participants, and investor behaviour. They provide an overview of FINC3014, the teaching team, learning outcomes, and the prescribed textbook. The content covers trading basics, market orders and properties, and an introduction to Rotman Interactive Trader (RIT). The notes delve into the trading industry, different trading instruments, market execution structures, and floor versus automated trading systems.

There are lectures on large traders and market impact costs, dealer markets, investor behaviour, and evaluating markets and investments. Topics also include market efficiency, portfolio performance, and market extremes. Arbitrage in real trading markets, market consolidation versus fragmentation, computerized trading, distressed markets, predatory trading, and market manipulation are also discussed.

Overall, the notes provide a comprehensive understanding of various aspects related to trading and the financial markets.

Excerpt:

Trading and Dealing in Security Markets

LECTURE 1: TRADING BASICS

PART 1: AN OVERVIEW OF FINC3014

1.1 – THE STRUCTURE

• Each week, there will be a 2-hour lecture and 1-hour tutorial workshop

• Lecture material (2 hours)

o Available for download on CANVAS

o Provide generalized material on topics covered each week. Students should also undertake additional reading

from the prescribed textbook and other additional resources provided.

• Tutorial workshops (1 hour)

o Will be conducted online via Zoom

o You must come prepared to class and participate in answering tutorial questions.

o Several tutorial workshops will also use Rotman Interactive Trader to simulate real markets. These are designed to give you a real-world understanding and “hands-on” experience of actual trading.

1.2 – THE TEACHING TEAM

• Unit Coordinator

o Dr Reuben Segara

• Head tutor Other tutors

o Mr James Kennedy

o Ms Jessica Zhang

o Mr Andoreal Chen

1.3 – UNIT LEARNING OUTCOMES

1. Identify the processes by which security prices come about, why and how trading occurs.

2. Discuss how financial decisions by corporations turn into trades that move prices in exchanges.

3. Connect the theory of corporations to the visible financial market news in the media, as demonstrated by tutorial participation in class.

4. Put your trading strategies into practice and evaluate them with a real-time trading simulator.

5. Build Algorithms to Execute Trades automatically.

Reviews