IAS 2 on Inventories

Summary:

- Definition [IAS 2.6]:

- Inventories are assets held for sale in regular business, in production for such sales, or as materials to be consumed in production or service provision.

- Examples include raw materials, work in progress, finished goods, and goods for resale.

- Measurement:

- Inventories are valued at the lower of cost and net realizable value.

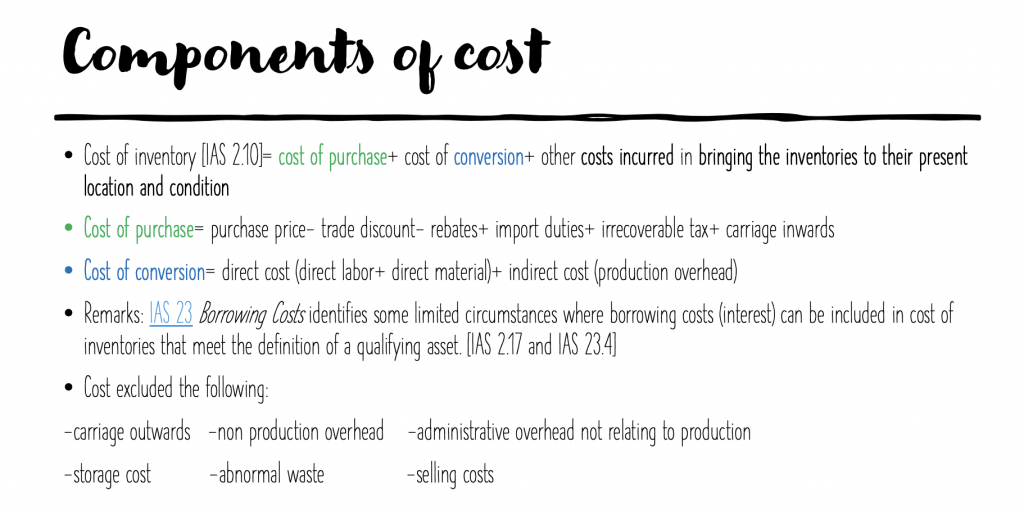

- Components of Cost:

- Inventory cost = cost of purchase + cost of conversion + other associated costs.

- Exclusions from cost: carriage outwards, non-production overhead, administrative overhead unrelated to production, storage cost, abnormal waste, and selling costs.

- Certain borrowing costs may be included under specific conditions.

- Net Realizable Value (NRV):

- NRV is the estimated selling price minus estimated completion and sales costs.

- Write-downs to NRV are recorded as an expense, and reversals are noted in the income statement.

- Reasons for write-downs include damaged or obsolete goods or increased costs/fallen sales prices.

- Double Entry for Write Down:

- Sale of inventories: Dr Cost of Sales (COS) Cr. Inventory

- Write-down of inventory: Dr COS Cr. Inventory/Inventory allowance

- Reversal of write-down: Dr Inventory/Inventory allowance Cr. COS

- Pricing Method:

- FIFO: Earliest inventory items are sold first.

- Weighted Average Cost: Average cost determined from similar items over the period.

- LIFO: Not allowed under IAS 2.

- Spare Parts:

- Classified either under Inventories (IAS 2) or PPE (IAS 16) based on usage and duration.

- Depreciation charges vary based on the immediate or delayed use of the spare parts.

- Receipt of Free Assets:

- Received from government, supplier, customer, shareholders, or others.

- Treatment varies based on the source and conditions attached, often recorded at Fair Value.

- Account within the Context of a Contract:

- Deals with non-cash considerations, and allocation principles are applied based on contract specifics.

- Discounts:

- Varies based on perspective (buyer or seller).

- Treatment depends on the reason for the discount, such as a settlement or a sales strategy like “Buy 1 Get 1 Free”.

Excerpt:

IAS 2 on Inventories

Definition [IAS 2.6]:

- Inventories are assets:

- Held for sale in the ordinary course of business

- In the process of production for such sale

- In the form of materials or supplies to be consumed in the production process or in the rendering of services – Eg: Raw material, work in progress, Finished Goods, Goods for resale (trading)

Reviews