GST Valuation (Grade A)

Summary:

Excerpt:

GST Valuation

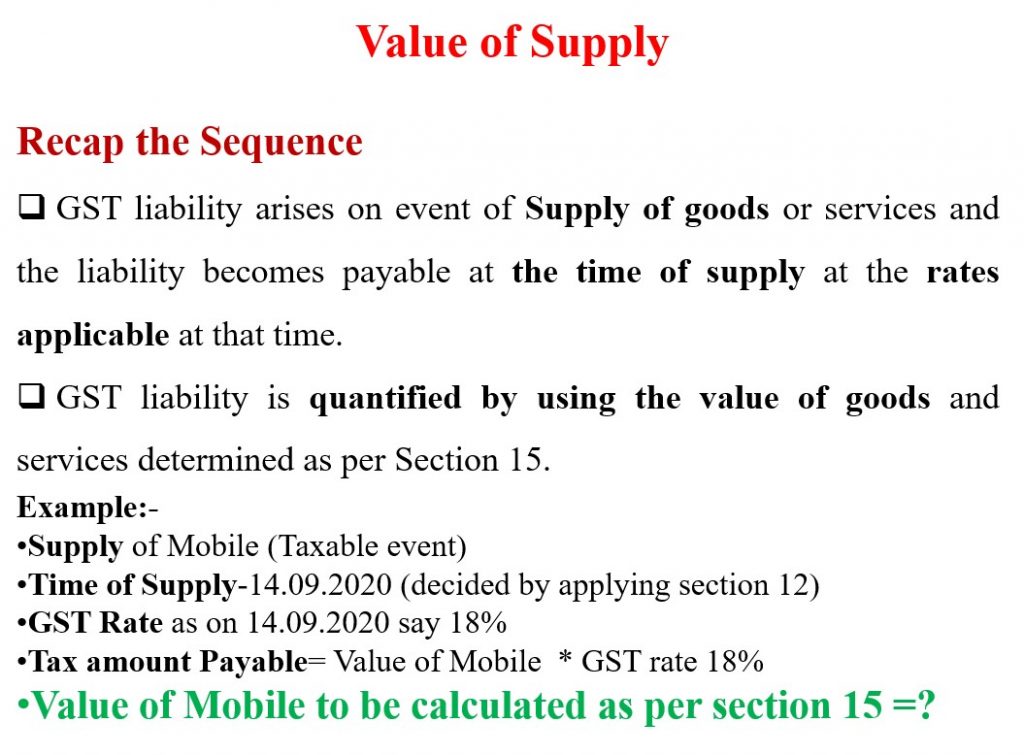

Value of Supply

Recap the Sequence

- GST liability arises in event of the Supply of goods or services and the liability becomes payable at the time of supply at the rates applicable at that time.

- GST liability is quantified by using the value of goods and services determined as per Section 15.

Example:

- Supply of Mobile (Taxable event)

- Time of Supply-14.09.2020 (decided by applying section 12)

- GST Rate as of 14.09.2020 say 18%

- Tax amount Payable= Value of Mobile * GST rate 18%

Value of Mobile to be calculated as per section 15 =?

According to section 15 -the value of a supply of goods or services or both shall be Calculated by Transaction Value Method

What is Transaction Value?

Transaction Value is the price:

- Actually paid or payable*; provided

- The supplier and the recipient of the supply are not related; and

- The price is the sole consideration

The price actually paid or payable shall include the following payments/expenses if not already added:-

1. Any taxes, duties, cesses, fees, and charges levied under any law other than GST laws if charged separately by the supplier.

Example:

As per the rent contract of Rs 1,00,000, the tenant is required to pay a local tax of Rs 10,000 directly to the local body or to the owner of the premise. Such local tax may form part of the consideration for the supply of renting service and GST would be charged on Rs 1,10,000.

2. Any amount or expenses incurred by the recipient that the supplier is liable to pay

Example:

Mr. X, the purchaser, has placed an order to supply a product “Packed in Carton” from Mr. Y (supplier). As per the contract, Mr. Y is required to deliver the goods to the premises of Mr. X. Thereafter Mr. Y hires a transporter for the transportation of goods. The lorry receipt of which indicates that freight is payable by the receiver of goods (Mr. X). In this case, Mr. Y was required to make the payment to the transporter as it is the obligation of Mr. Y to deliver the goods to the premises of Mr. X.

Reviews