GST Structure (Grade A)

Summary:

GST is a consumption-based tax implemented in India since July 2017, replacing multiple previous taxes. It covers the supply of goods and services, with rates ranging from NIL to 28%. The tax is divided into CGST, SGST/UTGST, and IGST, with administrative control under state governments and UT authorities. It features a common IT platform for filing returns and paying taxes online.

Pros of GST include simplification, development of a national market, uniform prices, reduction in goods and services prices, transparency, reduced compliance costs, and a boost to businesses and the economy. Cons include the dual tax system, complex transition, increased compliance requirements, adverse effects on some industries, multiple tax slabs and exemptions, computerization challenges for small businesses, and cumbersome rules and procedures.

Excerpt:

GST Structure

GOODS AND SERVICE TAX

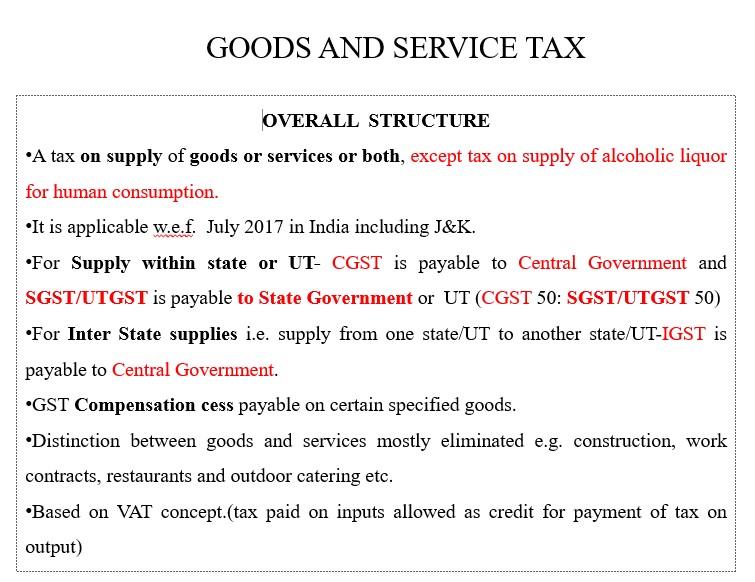

OVERALL STRUCTURE

- A tax on the supply of goods or services or both, except tax on the supply of alcoholic liquor for human consumption.

- It is applicable w.e.f. July 2017 in India including J&K.

- For Supply within the state or UT- CGST is payable to Central Government and SGST/UTGST is payable to State Government or UT (CGST 50: SGST/UTGST 50)

- For Inter-State supplies i.e. supply from one state/UT to another state/UT-IGST is payable to Central Government.

- GST Compensation cess payable on certain specified goods.

- The distinction between goods and services was mostly eliminated e.g. construction, work contracts, restaurants, outdoor catering, etc.

- Based on the VAT concept (tax paid on inputs allowed as a credit for payment of tax on output).

- GST is a consumption-based tax – Paid in the state where goods and services are finally consumed.

- Rate structure-NIL,0.1%,0.25%,3%,5%,12%,18% and 28%

- Administrative control with the State Governments/UT Authorities

- Petroleum products are out of GST at present

- Tobacco products are subject to Excise duty as well as GST

- Controlled and Monitored by GST Council

Reviews