GST Scope of Supply

Summary:

The note provides information on the GST Scope of Supply under the GST Act, specifically Section 7. Supply includes any form such as sale, transfer, barter, exchange, license, rental, lease, or disposal made for consideration, done by a person, and done in the course or furtherance of business. The import of services for consideration is also included in the scope of supply. Additionally, the note covers the activities specified in Schedules I, II, and III of the GST Act, which determines whether an activity is treated as a taxable supply or not. The note also lists activities or transactions that are treated neither as the sale of goods nor the sale of services, as per Schedule III of the GST Act.

Excerpt:

GST Scope of Supply

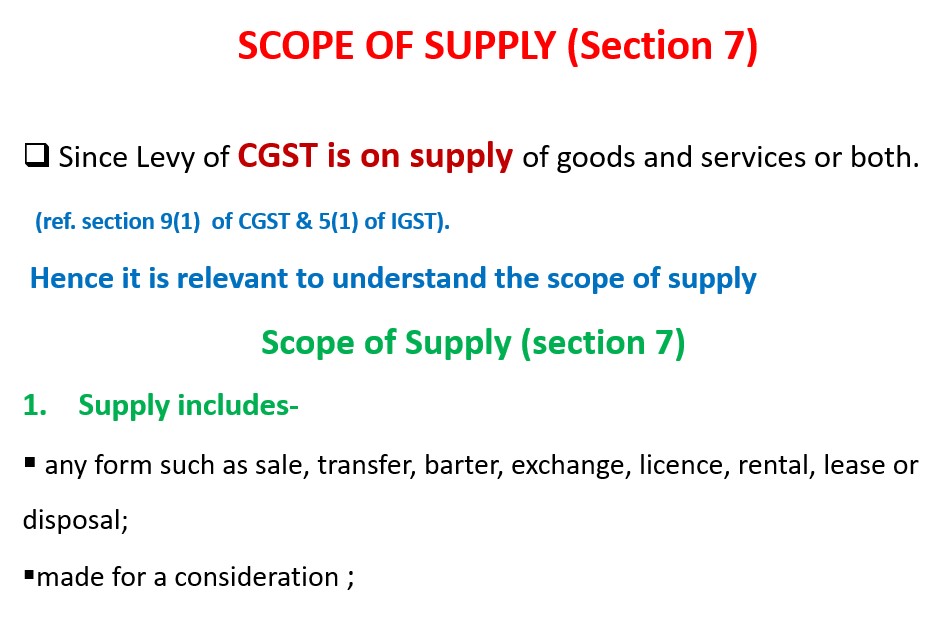

Since the Levy of CGST is on the supply of goods and services or both, (ref. section 9(1) of CGST & 5(1) of IGST).

Hence it is relevant to understand the scope of the supply

Scope of Supply (section 7)

1. Supply includes:

– any form such as sale, transfer, barter, exchange, license, rental, lease, or disposal;

– made for a consideration

– Done by a person;

– Done in the course or furtherance of business.

2. Import of services for consideration -whether or not in the course or furtherance of business.

3. Supply w.r.t the activities specified in Schedule I even without consideration shall be treated as taxable

4. Supply w.r.t the activities referred to in Schedule II

5. Activities or transactions specified in Schedule III shall not be treated as a supply

6. Notified activities or transactions undertaken by Government ( Central Government/ State Government/ any local authority shall also be not treated as a supply

Activities to be treated as supply without consideration as per Schedule I

Permanent transfer/disposal of business assets.

Temporary application of business assets to private or non-business use.

Services put to private or non-business use.

Assets retained after deregistration.

Supply of goods and/or services by a taxable person to another taxable or nontaxable person in the course or furtherance of business.

Reviews