GST Returns Notes (Grade A)

Summary:

Goods and Services Tax (GST) is a tax levied on the supply of goods and services in India, which replaced several indirect taxes. It is a comprehensive, multi-stage, and destination-based tax system that aims to streamline the tax structure and reduce the burden of multiple taxes on businesses.

Under GST, every registered person paying GST is required to file an electronic return at prescribed intervals. A GST return is a document that shows the income or business details for determining tax liability and making payments.

Initially, the GST return filing procedure demanded taxpayers disclose various details, including outward supplies (sales), inward supplies (purchases), GST on output, input tax credit, and other particulars as prescribed in the document. However, the initial system has undergone modifications. It is essential for taxpayers to be aware of the current requirements and procedures for filing GST returns to avoid penalties and compliance issues.

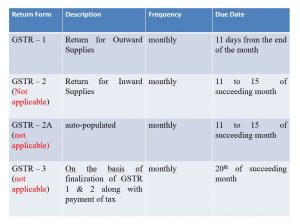

Under the GST regime, there are different types of returns that taxpayers need to file based on their business type and turnover. Some of the common GST returns include GSTR-1, GSTR-2, GSTR-3B, and GSTR-4.

In summary, GST return filing is an important compliance requirement for businesses under the GST regime in India.

Excerpt:

GST Returns

- Return is a document that shows the income or business details for the purpose of determination of tax and payment thereof.

- Every registered person paying GST is required to furnish an electronic return at prescribed intervals.

- Under the initial GST Return filing procedure, the different types of GST returns demanded the taxpayer to disclose the following details: Outward Supplies (Sales), Inward Supplies (Purchases), GST On Output, GST on Input (Input Tax Credit), and any other Particulars (As May be Prescribed in the Document). However, at present, there is a modification in the initial system.

GST Returns

Reviews