GST Definitions Part 2 (Grade A)

Summary:

This GST Definitions note provides an overview of essential GST terms, such as Person, Place of Business, and Reverse Charge, which are critical for understanding the nuances of the tax system. The term “Person” encompasses a broad range of entities, including individuals, Hindu Undivided Families, companies (including government companies), firms, limited liability partnerships, associations of persons, bodies of individuals, cooperative societies, local authorities, governments, trusts, and artificial juridical persons.

The concept of “Place of Business” refers to the specific locations where business activities take place or where records, such as financial records or inventory, are maintained. This can include the primary place where the business is carried out, as well as warehouses, godowns, or any other locations where the taxable person stores or receives goods or services. Places, where agents conduct business on behalf of the taxable person, are also considered as part of the Place of Business.

Excerpt:

GST Definitions Part 2

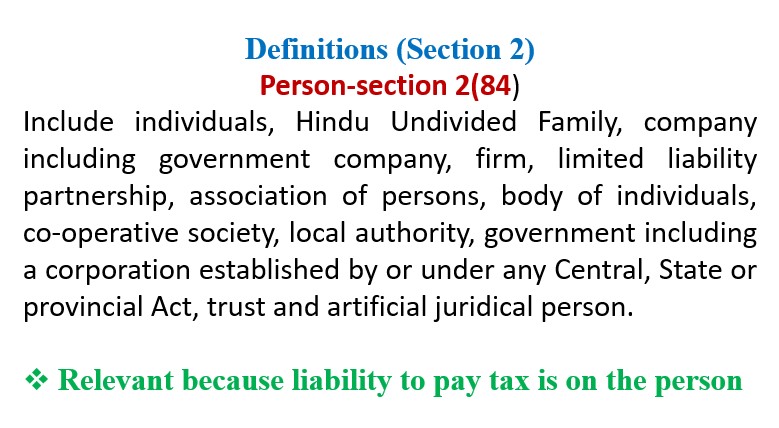

Person-section 2(84)

Include individuals, Hindu Undivided Family, companies including government companies, firms, limited liability partnerships, associations of persons, bodies of individuals, cooperative society, local authority, government including a corporation established by or under any Central, State, or Provincial Act, trust and artificial juridical person.

Relevant because the liability to pay tax is on the person

Place of Business-Section 2(85)

Includes:

(a) a place from where the business is ordinarily carried on and includes a warehouse, a godown or any other place where a taxable person stores his goods, supplies, or receives goods or services or both; or

(b) a place where a taxable person maintains his books of account; or

(c) a place where a taxable person is engaged in business through an agent, by whatever name called.

In a nutshell:

- A place from where business is run

- Warehouse, godown, place of maintenance of books of accounts, or an agents place

Relevant because it is proof of the existence of the business and all statutory compliances are to comply from this place.

Reviews