Fundamentals of Accounting

Summary:

The fundamentals of accounting encompass various key concepts and principles. Ethics plays a crucial role, in ensuring that accounting information is presented with integrity and honesty. Generally Accepted Accounting Principles (GAAP) define acceptable accounting practices to make financial statements relevant, reliable, and comparable. GAAP is established by groups like the Financial Accounting Standards Board (FASB), Securities and Exchange Commission (SEC), and International Accounting Standards Board (IASB). Accounting principles include cost, objectivity, revenue recognition, matching, and full disclosure. Assumptions such as going concern, monetary unit, time period, business entity, and conservatism guide accounting processes. The Sarbanes-Oxley Act (SOX) was enacted to prevent financial abuses, mandating strict internal controls and oversight for public companies to ensure compliance and transparency.

Excerpt:

Fundamentals of Accounting

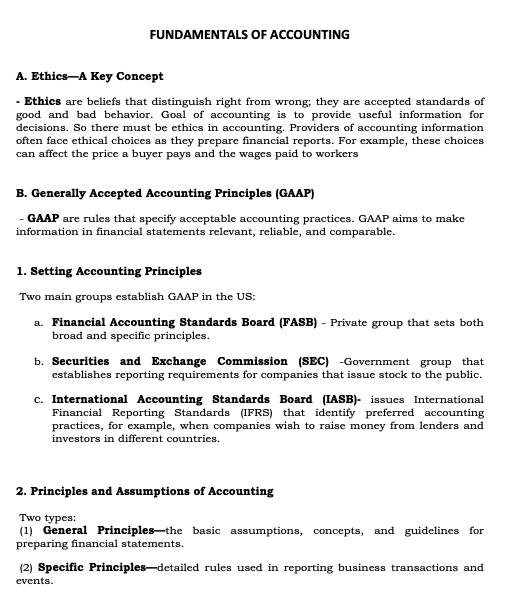

FUNDAMENTALS OF ACCOUNTING

A. Ethics—A Key Concept

– Ethics are beliefs that distinguish right from wrong; they are accepted standards of good and bad behaviour. The goal of accounting is to provide useful information for decisions. So there must be ethics in accounting. Providers of accounting information often face ethical choices as they prepare financial reports. For example, these choices can affect the price a buyer pays and the wages paid to workers.

B. Generally Accepted Accounting Principles (GAAP)

– GAAP rules that specify acceptable accounting practices. GAAP aims to make information in financial statements relevant, reliable, and comparable.

1. Setting Accounting Principles

Two main groups establish GAAP in the US:

- Financial Accounting Standards Board (FASB) – Private group that sets broad and specific principles.

- Securities and Exchange Commission (SEC) -Government group establishing reporting requirements for companies that issue stock to the public.

- International Accounting Standards Board (IASB)- issues International Financial Reporting Standards (IFRS) that identify preferred accounting practices, for example, when companies wish to raise money from lenders and investors in different countries.

2. Principles and Assumptions of Accounting

Two types:

(1) General Principles—the basic assumptions, concepts, and guidelines for preparing financial statements.

(2) Specific Principles—detailed rules for reporting business transactions and events.

Reviews