BANK3011 Bank Financial Management

Summary:

This note offers a comprehensive overview of risk management in the financial system, focusing on banks. It covers topics such as the role of banks in the financial system, interest rate risk measurement, market risk and Value at Risk (VaR) application, credit risk measurement for individual loans and loan portfolios, fintech risk, credit risk management techniques, sovereign risk measurement and management, liquidity risk measurement and management, deposit insurance and liability guarantees, and capital adequacy. Drawing from lecture notes, readings, and the textbook, this resource equips students with a deep understanding of risk assessment, measurement, and management within the financial sector, particularly in the context of banks’ operations.

Excerpt:

BANK3011 Bank Financial Management

BANK3011 NOTES

LECTURE 1: OVERVIEW

1. MAIN QUESTIONS

• In this lecture, we will answer the following questions:

o What roles do Financial Institutions (FIs) perform in the financial market, and why are they ‘special’, especially commercial banks?

o What happens if FIs are not managed properly? What are the consequences of FI failures?

o What should we (market participants, regulators, and policymakers) do to prevent FI failures?

2. WHAT DO FIS DO? (ESPECIALLY THE COMMERCIAL BANK)

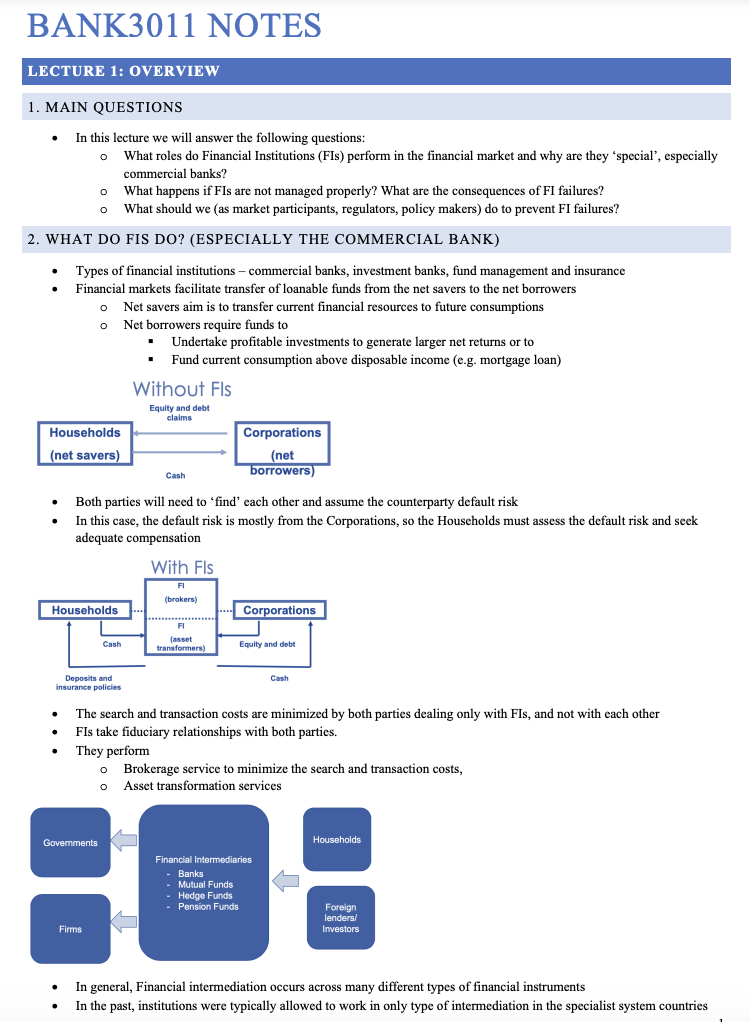

• Types of financial institutions – commercial banks, investment banks, fund management and insurance

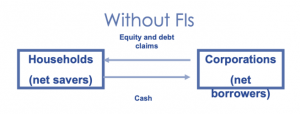

• Financial markets facilitate the transfer of loanable funds from the net savers to the net borrowers

o Net savers aim to transfer current financial resources to future consumption

o Net borrowers require funds to

§ Undertake profitable investments to generate larger net returns or to

§ Fund current consumption above disposable income (e.g. mortgage loan)

BANK3011 Bank Financial Management

• Both parties will need to ‘find’ each other and assume the counterparty default risk

• In this case, the default risk is mostly from the Corporations, so the Households must assess the default risk and seek adequate compensation

BANK3011 Bank Financial Management

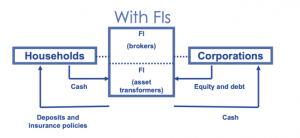

• The search and transaction costs are minimized by both parties dealing only with FIs, and not with each other

• FIs take fiduciary relationships with both parties.

• They perform

o Brokerage service to minimize the search and transaction costs,

o Asset transformation services

Reviews