Advanced Financial Accounting Notes

Summary:

Consolidated financial statements present the financial position of a parent company and its subsidiaries as a single entity. They include the Consolidated Statement of Financial Position (SFP), where assets and liabilities of the parent and subsidiaries are combined line by line, and the investment by the parent in the subsidiary’s ordinary shares is replaced by goodwill. Only the parent’s share capital and share premium are reported in the consolidated SFP. The group retained earnings are calculated as the sum of the parent’s retained earnings and the holding percentage of the subsidiary’s post-acquisition profit. Non-controlling interest (NCI) is reported after equity in the consolidated SFP. When a subsidiary’s assets are revalued, adjustments are made for NCI and post-acquisition profits. Intra-group transactions and balances, such as receivables and payables, sales and purchases of goods, and sale and purchase of fixed assets, must be eliminated to avoid double counting. For consolidated profit or loss and other comprehensive income, all incomes and expenses of the parent and subsidiary are added line by line after eliminating the effects of intra-group transactions. Profit attributable to NCI is calculated by multiplying the NCI percentage with the subsidiary’s profit.

Excerpt:

Advanced Financial Accounting Notes

Consolidated financial statements

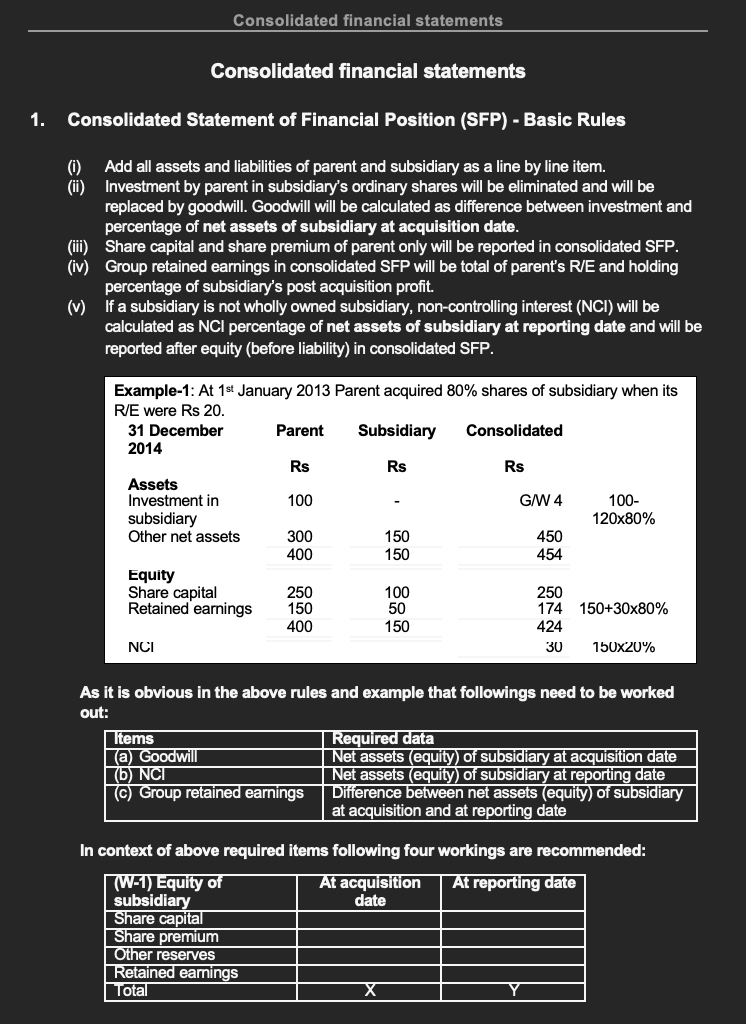

- Consolidated Statement of Financial Position (SFP) – Basic Rules

- Add all assets and liabilities of the parent and subsidiary as a line-by-line item.

- Investment by a parent in the subsidiary’s ordinary shares will be eliminated and will be replaced by goodwill. Goodwill will be calculated as the difference between investment and the percentage of net assets of the subsidiary at the acquisition date.

- Share capital and premium of parent only will be reported in consolidated SFP.

- The group retained earnings in consolidated SFP will be the total of the parent’s R/E and the holding percentage of the subsidiary’s post-acquisition profit.

- If a subsidiary is not a wholly owned subsidiary, non-controlling interest (NCI) will be calculated as an NCI percentage of net assets of a subsidiary at the reporting date and will be reported after equity (before liability) in consolidated SFP.

Reviews