Accounting for Beginners

Summary:

This Accounting for Beginners note provides an introduction to the field of Accounting and Business. It covers various key aspects and principles related to these areas. The chapter begins by highlighting the concept of donations and the purpose of businesses in selling goods and services while maintaining a good reputation. Ethics is emphasized as the guiding principle for businesses, ensuring responsible behaviour and integrity. Financial statements are introduced as essential tools for assessing a company’s financial performance and position. The chapter further explores financing activities, which involve obtaining funding, and investing activities, which focus on acquiring and disposing of long-term assets. Operating activities, such as buying and selling goods, are discussed in relation to day-to-day business operations. The chapter then delves into fundamental accounting principles, including the identification, recording, and communication of financial information. Key characteristics such as relevance, reliability, comparability, verifiability, and timeliness are explained. The users of accounting information, such as managers, employees, government agencies, creditors, and investors, are also highlighted, emphasizing the importance of accounting information in decision-making and evaluation processes.

Excerpt:

Introduction to Accounting and Business

Donations:

- Business – An economic entity that aims to sell goods and services to customers while ensuring profitability and maintaining a good reputation.

- Ethics – Distinguishing right from wrong, accepting responsibility, and conducting business with good behaviour and integrity.

- Financial statements – Financial reports that provide information about the financial performance and position of a company, including the income statement, balance sheet, and cash flow statement.

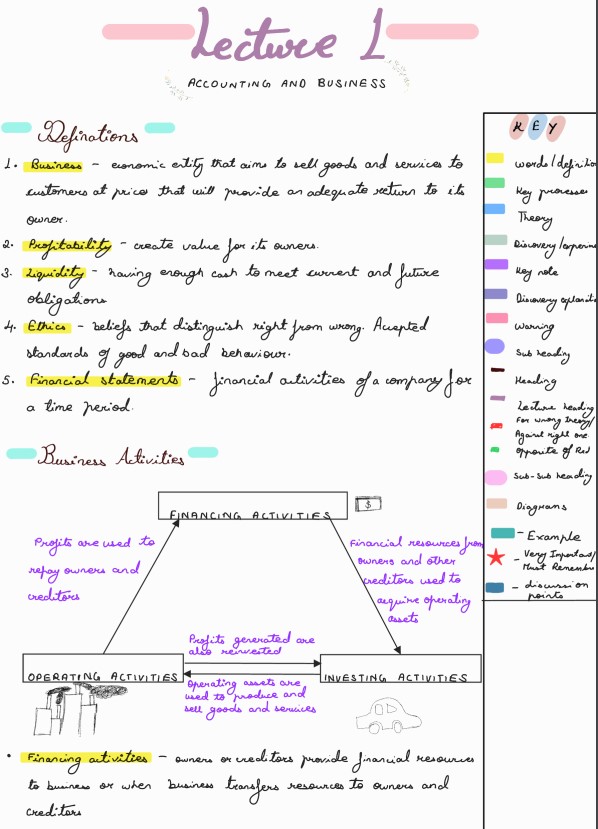

- Financing activities – Activities related to obtaining funding for the business, such as issuing shares or taking loans.

- Investing activities – Acquiring and disposing of long-term assets, such as property, plant, and equipment.

- Operating activities – Activities related to the day-to-day operations of the business, including buying and selling goods and services.

Accounting Principles:

- Identification – Identifying and recognizing economic events and transactions relevant to the business.

- Recording – Systematically recording financial information accurately and comprehensively.

- Communication – Summarizing and presenting financial information clearly and understandably.

- Relevance – Ensuring that the accounting information is useful for decision-making purposes.

- Reliability – Providing reliable and trustworthy financial information.

- Comparability – Ensuring consistency and comparability of financial information over time and across different companies.

- Verifiability – Ensuring that financial information can be verified and substantiated by evidence.

- Timeliness – Providing financial information in a timely manner to meet the needs of decision-makers.

Reviews